AI Assisted CRE Underwriting & Origination Platform

Automated. Easy.

CapLogiq brings together commercial real estate owners, mortgage brokers, capital providers (lenders and equity investors), and service providers for a transaction onto a single cloud enterprise-ready and interconnected platform. It automates highly manual, labor-intensive, redundant processes to make closings faster, simpler and more efficient by moving through the commercial real estate value chain. CapLogiq delivers at least 20x savings to all parties involved in an addressable market of $430 billion per year of transaction volume*

* According to CREFC - Commercial Real Estate Finance Council

Everyone Wins

MORTGAGE BROKER

- Professional Marketing Packages

- Seamless Information Exchange

- Quick Turnaround

- Efficient Deal Pipeline Management

CAPITAL PROVIDERS

- Feature-Rich Underwriting Models

- AI-Assisted Valuation and Loan Pricing

- Intelligently and Automatically Curated Data for Informed Decisions

- Investment Risk Scorecard

OWNERS

- Improved Transparency

- Easy Deal Tracking & Due-Diligence Process

- Deal updates on the move

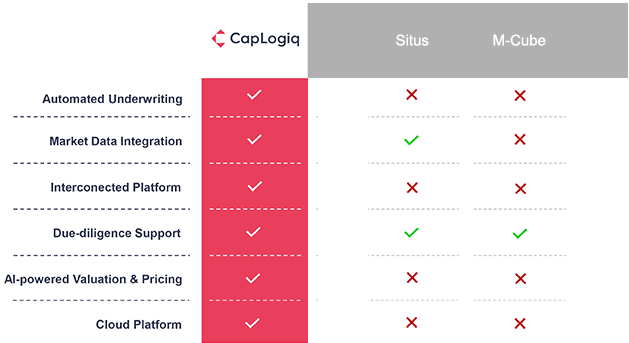

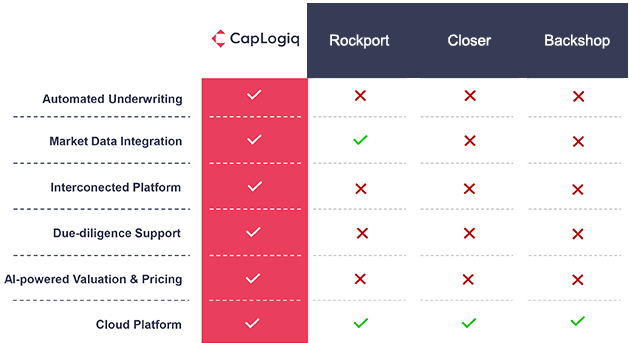

Compare

Service Companies

Product Companies

About Us

Rushi Shah

Principal & CEO – Mag Mile Capital

Rushi Shah is Principal and CEO of Mag Mile Capital (formerly Aries Conlon Capital), a commercial real estate investment banking firm with over $8.5 billion of transaction experience.

Personally Rushi has closed over a billion dollars of CRE loans. Rushi’s specialty includes hotel debt and equity closings. Rushi is an entrepreneur with deep relationships on Wall Street. Prior to Mag Mile, Rushi spent 10 years on Capital Markets desk of Northern Trust specializing in over- the-counter derivatives products. Rushi contracted and implemented an enterprise level derivatives system for the company’s balance sheet derivatives activities.

Rushi frequently speaks on non-recourse financing markets, getting complex deals done, and writes regularly as a financing expert. Rushi has an MBA from Chicago Booth and has undergraduate degree from University of Illinois. Rushi deeply understands technology and appreciates the changing landscape of tech in CRE Finance industry.

Mag Mile Capital

Full-service, commercial real estate mortgage & investment banking firm

Chicago-based Mag Mile Capital is a full-service, commercial real estate mortgage and investment banking firm. The boutique firm offers preferred access to best-in-class debt placement, equity arrangement, tax credit syndication, real estate brokerage and advisory through a high-touch, disciplined approach that leverages its extensive lending relationships and deep-rooted client and equity sponsors. During the past 29 years, team members have collectively funded over $9 billion in debt, equity, tax credit and mezzanine financing for hotel, multifamily, office, retail, industrial, healthcare, self-storage and special purpose properties throughout the United States and the Caribbean. Mag Mile Capital provides:

Debt Placement:

- Permanent debt for stabilized assets

- Bridge loans for properties in transition

- Mezzanine financing

- Capital for note purchases and discounted payoffs (DPOs)

- Credit Tenant Lease (CTL) acquisitions

- Construction financing

- Participating mortgages and stretch senior loans

Equity Arrangement: Preferred equity, JV equity, programmatic fund-level multi-property acquisition strategy

Tax Credit Syndication: Federal & state new markets tax credits, Historic tax credits, affordable housing tax credits, tax increment financing